-

Mobile business development for Insurance Agent

-

Mobile business development for group insurance

-

Smart operation

-

Smart Customer Service

-

Web based Insurance Core System

-

Insurance intermediary service

-

Multi-channel multimedia marketing

Overview

This system is applicable for sales representatives to acquire customers via WeChat, and to purchase insurance products on mobile terminals. It promotes products by posting marketing campaigns or articles, and supports SaaS and localized deployment modes.

This system serves the following purposes

Cost effectiveness: Electronic workflow significantly reduces documentation, file and labor costs

Scenario Extend: Based on smart mobile terminals, various business models and sales scenarios such as part-time agents and O2O could be extended

Operation efficiency: Smart data transmission greatly improves operational timeliness and job accuracy

Overview

It is applicable to various scenarios such as group insurance and business development, while supporting all stages of the process during group insurance business development.

This system serves the following purposes

Improving the efficiency of the incoming flow and new contracts through the systematic management of the whole process of group insurance policy sales and standard quotation process with the assistance of various data statistics functions.

Ensure effective monitoring and use of various data of the group insurance business for better decision-making and analysis, and refined management of the group insurance business.

Improving the user experience and information security through smart recognition technologies such as facial recognition, fingerprint recognition, OCR and voiceprint recognition based on different application scenarios

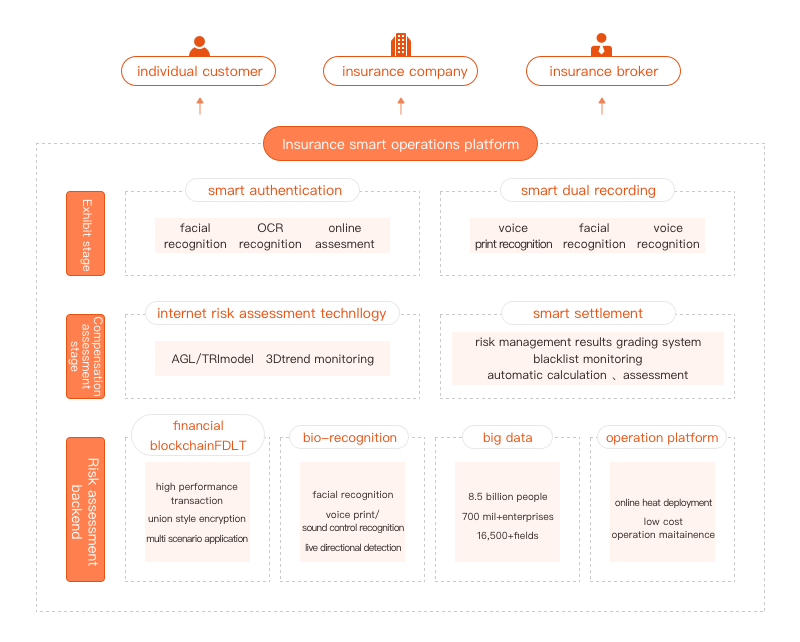

Overview

It is applicable to business scenarios such as client identity verification by field agents of small- and medium-sized insurance companies during the insurance sales process, and the insurance companies implementing risk management rating and black/white list monitoring in the settlement process of medical insurance cases.

This system serves the following purposes

Full-process risk management of all the whole insurance sales chain, preservation and policy claim, thus improving the comprehensive risk managing capability.

“intercepting” by means of facial recognition, voiceprint recognition and other technologies for improving the risk management level

Quick access to multiple application scenarios, supporting multiple access methods such as OPEN API, mobile-terminal SDK embedding and H5 at the PC end

Introducing the dialog recording and screen recording mechanism into the sales process of insurance product integrated terminals, thus effectively avoiding misleading sales.

Supporting diagnosis and treatment data transmission in hospitals, and efficiently calculating the compensation amount via the smart calculation engine

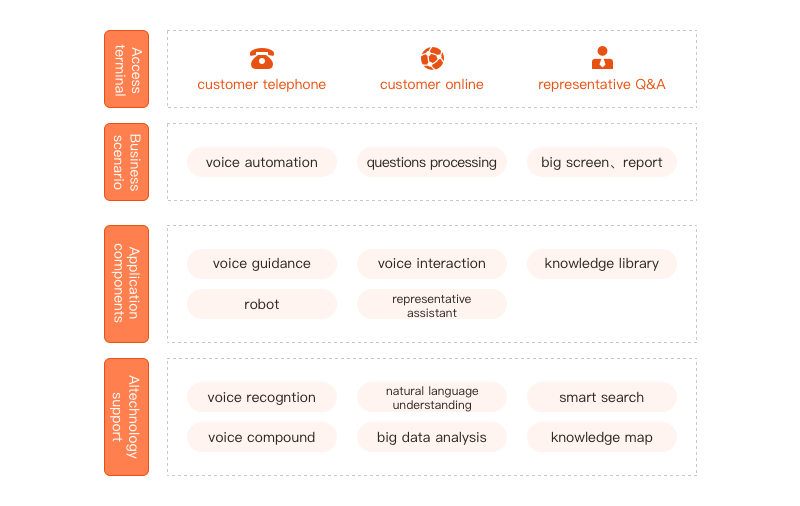

Overview

Applicable to upgrade and reconstruction of traditional client service systems to improve the efficiency of existing client services.

This system serves the following purposes

Unified client service portal for unified identification of client sources and access to professional client service platform, thus improving management efficiency and reducing management costs

Reducing labor costs and improving the user experience through smart scenario applications such as smart client service robots and voice navigation

Improving client satisfaction via accurate response business consultations based on user profiling for client services in various channels

User-unperceivable identity verification and self-service business process using AI technologies such as voiceprint recognition, speech synthesis and semantic recognition

Overview

Applicable to new insurance companies for quickly passing regulatory inspections before opening, helping small- and medium-sized insurance companies with building core systems for Internet business, minimizing assets of Internet insurance business and business innovation.

This system serves the following purposes

Quickly enter the Internet insurance business

Reducing the investment risk of the business system for the new insurance company in the early stages and quickly meeting the regulatory requirements

Internet insurance core system enabling configuration of product visualization page, fast delivery and reduced labor costs

Improve sales efficiency of agents and tapping more business opportunities by accessing agent integrated terminal tools

Overview

Insurance sales agency opening; quick access to new products via agents of products from multiple insurance companies; crossover cooperation between agent sales and tourism, travel, mother and child, e-commerce and the like for scenario-based quick launching and billing of insurance products.

This system serves the following purposes

Organizations only need to focus on the front end business and leave the most ponderous tasks for the cloud system to process, thus enabling quick opening of the business

Providing insurance agents representing multiple insurance company products with quick access to new products, mobile insurance, and release to all sales channels

Possesses big data modeling, client profiling and risk identification technologies to provide visualized operation analysis reports and unified pricing of products, i.e., people with different profiles are offered different prices

Synchronizing the clients' insurance information in real time with the premium directly entering the insurance company's fund account by accessing the insurance intermediary cloud platform.

Quick access to smart client service and data platform for efficient, smart and digital operation, thus saving labor costs

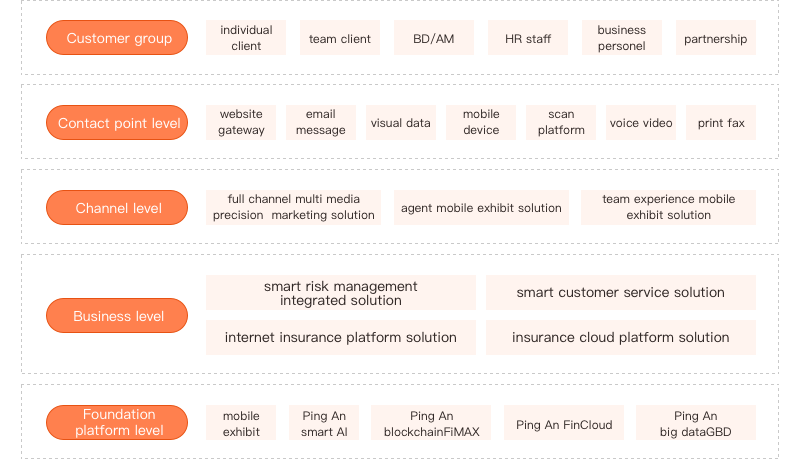

Overview

Applicable to the online and offline precision marketing of the insurance industry, such as marketing campaign management for stock clients, product marketing, new promotion and user migration

This system serves the following purposes

Transforming offline sales models in to online models for more efficient access channels

Improving the success rate of existing marketing models and reducing IT operation and maintenance costs for business development

Extracting client behavior information in real time for delivering products and services accurately

Integrating order information and interconnected policy insurance process, allowing users to fill uncompleted online sales orders at any terminal